THE US- CHINA TRADE WAR AND IT’S IMPACT ON THE GLOBAL ECONOMY

INTRODUCTION TO THE PROBLEM

Since China’s opening up with the introduction of Deng Xiaoping’s concept of the socialist market economy back in 1978, Chinese population living in poverty sharply declined from 88 per cent in 1981 to 6 per cent in 2017. The reform opened the country to foreign investment and reduced other trade barriers. Since 1978, the country’s economic growth, measured by its gross domestic product (GDP) has shot up and averaged 9.6 per cent per annum between 1978 and 2017. Against this background, I aim to analyse the empirical case: The current US- China trade war- which began in March 2018. A trade war is considered an unconventional war and could have a wide and profound impact on the financial, monetary and political landscapes of all economies part of it. Moreover, it is bound to result into frightening consequences such as company shut- downs, immense unemployment, deglobalization, currency crises, among more, few of which are already prominent between the United States and China. The trade war is labelled as probably “the worst trade war” seen in years.

CAUSES OF THE TRADE WAR

In 2018, The US trade deficit with China was $419 billion. This trade deficit existed because American exports to China were only $120 billion where as Chinese imports in the country were $540 billion. One of the main official reasons behind the war was China’s unfair competition strategy. Chinese corporations take advantage of America’s open markets, while keeping their own markets closed to American corporations and products. Due to this unfair competition, American industries face low output, job losses and factory closures. This left US with no option but to impose trade sanctions on Chinese products and companies. The entire situation is very similar to that of the 1980s when America’s “unfair” trade partner was Japan, the difference being, the trade friction between the two countries did not result in a fully-fledged war. The largest US exports and imports can be categorized as follows:

After US President Donald Trump took office, the US- China relationship deteriorated drastically. Throughout his presidential campaign, he has been vocal about his disapproval and displeasure with China’s trading practices. On March 22, 2018, the US Trade Representative released its “Section 301” report (a report prepared annually by the Office of the United States Trade Representative (USTR) which identifies trade barriers to companies and products of the United States due to intellectual property laws). On the very same day, President Trump, worrying about his country’s trade deficits and in a proposal to strengthen the economy, proposed a 25 percent tariff on certain Chinese products. Tariffs increase the price of foreign goods, and this directly encourages consumers to buy local goods, thus reducing the outflow of capital from the economy and increasing demand for local. This move by the US government resulted in China’s tit-for-tat measures, which eventually led to the trade war. Trump also imposed tariffs, duties and taxes on products manufactured abroad in countries like Mexico, Canada and the European Union. But the worst hit was China. (Zhang, 2018)

There are two major explanations behind Trump’s trade war with China. On the economic front, the administration aims to reverse or reduce its trade deficit. On April 4th, 2018, Trump tweeted, “[the United States has] a Trade Deficit of $500 Billion a year, with Intellectual Property Theft of another $300 Billion. We cannot let this continue!” It is believed that reducing the trade deficit would result in an increase in the GDP growth for US. These trade-related complications for the US economy have translated in slower growth, rising public debt, and fewer jobs.

On the political and more unofficial front, however, Trump and his government desire to slow down China’s progress towards developing into a technological superpower. The sectors mainly targeted are machinery, IT Technology and electronics. For America, being the world’s long-time technology leader, it is a matter of concern to see China’s rapid technological rise and quest to dominate emerging digital technologies.

IMPACT OF THE TRADE WAR

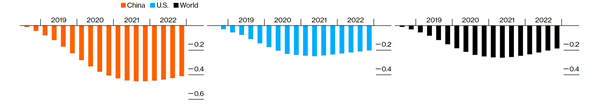

There are no real winners in this US-initiated trade war. Countries like United States facing new tariffs, experience a decline in their GDP and real exports. Other countries face a declining demand for their own exports, usually in response to weaker global economic growth. These effects offset any gains from trade diversion to avoid tariffs. In the current scenario, the US-China trade war has entered a dangerous phase. There’s the threat for tariffs to only increase in number and in percentage. On May 10th this year, US took tariff rates to 25% on $250 billion worth of Chinese goods. In swift retaliation, China raised tariffs on certain US goods between the range of 5 to 25 per cent. The following shows a percent impact on quarterly gross domestic product of US, China and the rest of the world, given the current tariff levels:

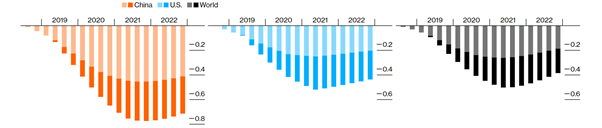

The US has threatened 25% tariffs on all Chinese imports to the country if a quick agreement cannot be achieved. What if the tariffs increase? The following shows a percent impact on quarterly gross domestic product of US, China and the world if 25% tariffs are plugged in on all bilateral trade:

The financial markets, on the other hand, have become extremely focused on the movements of the movements in the tariff negotiations between the two countries and, even more recently, due to the major probability of a technology war centred around US sanctions against Chinese multinational technology company Huawei. In the final quarter of 2018, the deterioration in US-China trade relations resulted in a collapse in stock markets across the world. Recently, it has been assumed that the same might happen again. However, there is an alternative explanation to the US markets collapsing in December last year. This explanation is that the collapse was not entirely, or even majorly, due to trade war shocks, but due to other economic developments. This is supported by the fact that earlier this May, the latest and most serious trade wars between the countries have been accompanied by a moderate decline of around 6 per cent in the US stocks which is much smaller than the meltdown in December. On the contrary, according to China’s securities market watchdog chief, any future risks affecting the securities market are “controllable” as China has already absorbed the shocks of the trade war until now. ( Sam & Holland, 2019)

The three industries most affected by the full-blown trade-war between the two countries are Automobiles, Technology and Agriculture. Let us examine these spheres in detail:

- AUTOMOBILES: This is one of the biggest sectors affected by the trade tensions. In retaliation to the US tariffs last year, China increased tariffs on the US- made automotive from 15% to 40%. While most Chinese consumers buy locally manufactured automobiles, US automotive like Tesla Inc. pay the price for such trade tensions. The company increased the price of two of it’s models by about $20,000 last year in July in retaliation to a new round of tariffs, however, later cut the prices. Since then, China suspended the additional 25% on the US automotive industry. China too, is on the receiving end of this complicated supply chain, implying that suppliers in US too spend more on parts from China when they are charged higher tariffs.

- TECHNOLOGY: The companies most vulnerable to the trade war scenario are the electronic manufacturers and chip makers that depend on Chinese markets for their sales. Some examples of these are Intel Corp., Micron Technology and NVIDA Corp. So far, Apple has escaped tariffs on its China-assembled phones, but if Trump does as he is threatening and imposes tariffs on all Chinese imports, the company would no longer be in the safe-zone. If the trade war and competition for tech dominance continues, China may strike back with heavy tariffs or choose to cripple American companies using other tactics.

- AGRICULTURE: China is one of the largest exporters of Agriculture for the US. In 2018, the total exports of agricultural products to China summed up to $9.3 billion according to the Office of the United States Trade Representative. As trade tensions have escalated, a chief concern area has been soybeans. By tradition, China has been the largest importer of US soybeans with over $3 billion worth imported in 2018. Other agricultural products imported by China in large amounts are coarse grains, pork and pork products, and cotton. Last year, China imposed an additional tariff on US soybeans which resulted in stock accumulation for American soybean farmers. In December, though, as a show of good faith, China bought $180 million worth of soybeans from the US. Still, this was only a small fraction of the amount that US soybean farmers lost last year. Another commodity highly affected by the trade tensions is cotton, for which China is now turning to countries like Brazil and India to meet its requirement. (Reiff, 2019)

THE G20 SUMMIT 2019: SIGNS OF PEACE

The G20 (Group of 20) Summit 2019 was held on 28-29 of June 2019 in Osaka, Japan. Trump and Xi finally held their highly anticipated bilateral meeting where in they have agreed to resume trade talks, easing the long row. Both sides confirmed in separate comments that they do not plan to impose any new tariffs against each other’s products, presently. Trump said that the bilateral went well and that both countries would continue their negotiations. Moreover, he suggested that he would soon be reversing the US government’s decision to ban American companies from selling products to Huawei. He also projected that following the meeting, China would be buying large quantities of US agricultural products, and Chinese students entering American Schools would be treated “Just like anybody else.” (Rosenfeld, 2019)

CONCLUSION AND RECOMMENDATIONS

Several attempts at negotiations and discussions have taken place between the trade representatives of the two countries. After the most recent tariff escalations, hopes for an imminent settlement seem far-fetched. In my personal opinion, the only way out of the trade tensions is if Donald Trump and Xi Jinping come to a consensus to agree to bilateral talks and end their respective trade aggressions. Both countries must refrain and withdraw the tariff hikes and retire to their initial positions. Instead, they could even strike a new deal, and negotiate concessions on both sides, with terms agreed upon by both parties. We can see a start to peace in their negotiations at the recent G20 Summit. However, the global economy is being held back by the tariffs already implemented. The damage already done cannot be reversed and may take a while to cease.

REFERENCES

Sam, C., & Holland, B. (2019, May 28). A $600 Billion Bill: Counting the Global. Retrieved from Bloomberg.com: https://www.bloomberg.com/graphics/2019-us-china-trade-war-economic-fallout/

Amadeo, K. (2019, June 22). US Trade Deficit With China and Why It’s So High. Retrieved from thebalance.com: https://www.thebalance.com/u-s-china-trade-deficit-causes-effects-and-solutions-3306277

Mourdoukoutas, P. (2019, January 24). US-China Trade War: The Official And Unofficial Reasons Behind It. Retrieved from Forbes : https://www.forbes.com/sites/panosmourdoukoutas/2019/01/24/us-china-trade-war-the-official-and-unofficial-reasons-behind-it/#471a128346da

Reiff, N. (2019, June 25). The Top 3 Industries Affected by the Trade War With China. Retrieved from investopedia.com: https://www.investopedia.com/industries-most-likely-to-be-impacted-by-trade-disputes-with-china-in-2019-4580508

Rosenfeld, E. (2019, June 2019). Trump says he agreed with Xi to hold off on new tariffs and to let Huawei buy US products. Retrieved from CNBC: https://www.cnbc.com/2019/06/29/us-china-trade-war-trump-and-xi-meet-at-g-20-summit-in-osaka.html

Zhang, Y. (2018). The US–China Trade War. jstor.org, December .

Very informative

LikeLike

Very inciteful!

LikeLike

Great choice of topic.

The blog is very informative

LikeLike

Lovely topic… Very informative.

LikeLike

Very informative. Choice of topic is very good 👍.

LikeLike

Very informative and so well written

LikeLike

Oh my god. This is such an informative article. I’m amazed at the amount you have spent on this. Good research.

LikeLike

Extremely relevant topic, very well written.

LikeLike

Loved it! Very informative

LikeLike

Badhiya hai

LikeLike

Well researched, very well articulated. Great work Devina!

LikeLike

Great insights. Good work

LikeLike

The content is well researched. It is very informative and extremely relevant.

LikeLiked by 1 person

Great content well written!

LikeLike

Great blog. Really informative.

LikeLike

Very nice, very good. This info not even on google.

LikeLiked by 1 person

Good research!

LikeLike

Extremely informative and brilliantly written

LikeLike

Very well articulated and great insights! Looking forward to more posts on this blog.

LikeLike

Great work, really informative! Looking forward to your future posts.

LikeLike

Great article.learned alot.please post more!

LikeLike

Well researched and informative. Easy for a layman to understand.

LikeLike

So insightful and informative. I learnt more here than i did in my 14 years of schooling.

LikeLike

Extremely comprehensive and very well articulated. Good job!

LikeLike

Very informative and well put together!

LikeLike

Very informative!

LikeLike

Great!!

LikeLike